External users include lenders shareholders customers and regulators – In the realm of business operations, external users—lenders, shareholders, customers, and regulators—play a pivotal role, relying heavily on financial information for informed decision-making. This discourse delves into the significance of these external stakeholders, exploring their unique perspectives and the crucial financial data they require.

External Users: Definition and Importance: External Users Include Lenders Shareholders Customers And Regulators

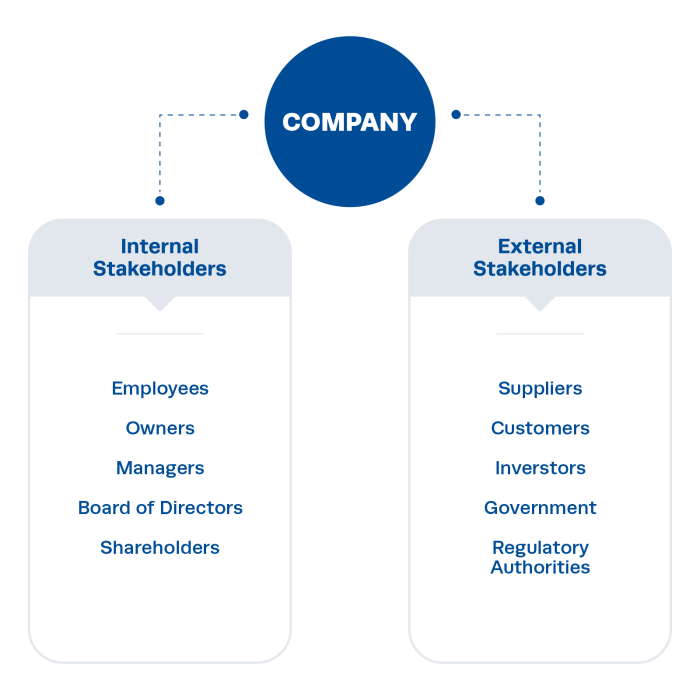

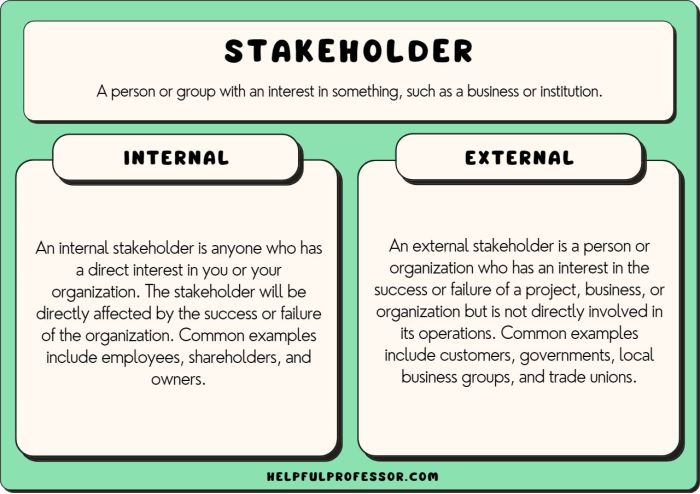

External users are individuals or organizations outside a business that rely on its financial information to make decisions. They play a crucial role in the success and sustainability of any business.

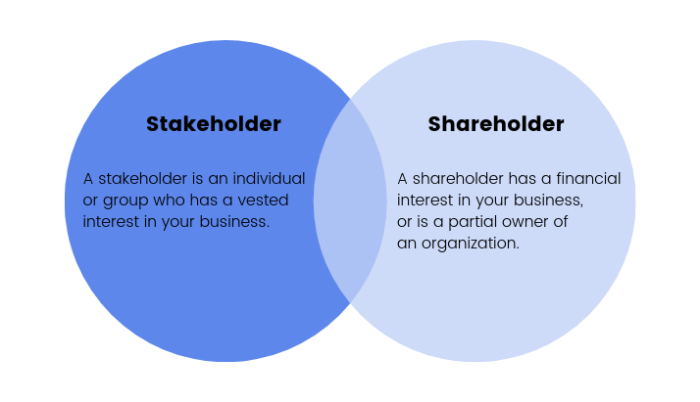

The primary types of external users include lenders, shareholders, customers, and regulators. Lenders provide financing, shareholders own the business, customers purchase its products or services, and regulators ensure compliance with laws and regulations.

Lenders: Role and Information Needs, External users include lenders shareholders customers and regulators

Lenders assess the financial health of businesses before providing loans. They require financial information such as financial statements, cash flow projections, and credit reports to evaluate the risk of default and determine appropriate loan terms.

Shareholders: Ownership and Financial Expectations

Shareholders expect a return on their investment in the form of dividends, capital appreciation, and voting rights. They rely on financial information to evaluate the company’s performance, assess management effectiveness, and make informed investment decisions.

Customers: Trust and Reliability

Financial information helps businesses build trust with customers by demonstrating financial stability and reliability. Customers may hesitate to do business with companies that appear financially weak or unstable.

Regulators: Compliance and Oversight

Regulators require financial information from businesses to ensure compliance with laws and regulations. This information includes financial statements, tax returns, and internal control documentation.

Common Interests and Information Sharing

External users share common interests in financial information, such as the company’s financial performance, financial stability, and future prospects. Businesses must effectively communicate this information to meet the needs of different user groups.

Case Studies: Real-World Examples

Case studies demonstrate how businesses have successfully managed their relationships with external users through effective financial reporting. These case studies provide valuable lessons for businesses looking to improve their external user engagement.

FAQ Guide

What is the primary role of lenders in relation to external users?

Lenders provide financing to businesses and assess risk through financial information, including financial statements, cash flow projections, and financial metrics.

How do shareholders contribute to the financial landscape?

Shareholders are owners of a business and have financial expectations, such as dividends, capital appreciation, and return on investment, which are informed by financial information.

Why is trust crucial for businesses in attracting and retaining customers?

Trust is essential for businesses to build strong customer relationships. Financial information plays a role in demonstrating financial stability and building trust with customers.

What is the role of regulators in the financial sphere?

Regulators ensure fair and transparent business operations by requiring financial information such as financial statements, tax returns, and internal controls for compliance purposes.